2021年07月23日

FX is an abbreviation of “Foreign Exchange”, which is translated as “foreign exchange trading” in Japanese, but nowadays FX generally means “foreign exchange margin trading “.

The difference between “foreign exchange trading” and “foreign exchange margin trading ” is whether or not foreign exchange trading is done on margin. In order to understand the difference between the two, let’s first learn what foreign exchange trading is and understand the mechanism of the settlement of margin used in FX trading.

Understanding the settlement of differences will give you an idea of how forex trading works, how much money is required, and what risks are involved.

When you travel from Japan to the U.S., you need to exchange yen to dollars. This exchange is called a foreign exchange transaction.

For example, when the exchange rate is 100 yen to the dollar, exchanging 1,000 Japanese yen for 1,000 dollars

requires 100,000 yen (100 x 1,000 = 100,000 yen).

In other words, you bought 1,000 dollars for 100,000 yen.

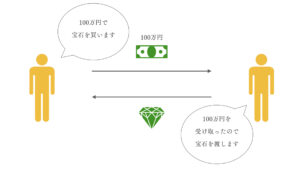

When we shop, we usually pay money and get things in return, as shown in the figure below. This exchange of cash and goods is called ” physical settlement. Foreign exchange trading is the same as physical settlement, where we pay money (yen) to buy something (dollars).

FX is traded on the basis of “settlement for difference,” in which you are promised to settle the transaction in the future. Settlement for difference does not require payment of money or delivery of goods. Instead, only the difference at the time of settlement is delivered.

In the Forex market, the terms “buy entry” and “sell entry” are used, but the settlement of a buy entry means “sell” and the settlement of a sell entry means “buy”.

Let us understand Settlement for Difference with an example of a familiar transaction.

To trade a million yen worth of jewelry for a settlement of difference, the following steps are taken

When settling the transaction, the following steps are taken

In this way, settlement for difference does not transfer cash or goods, but only the difference at the time of settlement, and in the same way in FX trading, only the difference is transferred instead of exchanging money each time.

Since Forex uses settlement by margin, you need to deposit “margin,” a cash amount ranging from several percent to several tens of percent of the trade amount, into your Forex account in order to make a trade. The margin deposit can be leveraged in forex trading. By applying leverage, you can trade currency at several times to several hundred times the amount of your margin.

For example, to buy $10,000 at an exchange rate of $1 = ¥100, you need ¥1,000,000. If the leverage is 100 times, you can buy $10,000 by depositing ¥10,000 in your FX account.

If you sell $10,000 when the exchange rate becomes 110 yen per dollar, your profit will be 1,100,000 yen (1,100,000 yen – 1,000,000 yen = 100,000 yen). Since only the result of the transaction is reflected in the account by settlement for difference, the profit of 100,000 yen is reflected in the account at the time of settlement.

In this way, FX allows you to trade even with a small amount of money because you can trade by applying leverage to your margin like the principle of leverage.

In FX, only the difference of trading is reflected in the account by settlement for difference. In addition, by combining leverage, you can trade many times more than the amount deposited in your account.

コントラは最高のFXアプリを

目指して誠意開発を続けております。

機能の要望や、不具合などありましたらご遠慮なくヘッダーの問い合わせ、フィードバックからご連絡ください。またツイッターからでも大丈夫です!

皆様のFXトレードのお力になるFXアプリを目指しますので、これからもよろしくお願いいたします。